Trading Cash Forex

Of course, you hope that you'll never have to use the policy, but you'll sure be happy when it's made available on a rainy day. A nominal quotation is the hypothetical price at which a security might trade. Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. For our 2020 Forex Broker Review we assessed, rated, and ranked 30 international forex brokers. Each broker was graded on 105 different variables and, in total, over 50,000 words of research were produced.

The following two traits (among many) are easily overlooked but contribute to gambling tendencies in traders. The average daily amount of trading in the global forex market. Risk management is where you only risk a small amount of the account on any single trade. If you want to day trade, there are a few more things you may want in a broker.

This calculation shows that while the trader has winning and losing trades, when the trades are averaged out, the resulting profit is one tick or higher. A trader that averages one tick per trade erases fees, covers slippage and produces a profit that would beat most benchmarks. Many of those who try it fail, but the techniques and guidelines described above can help you create a profitable strategy.

The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. If your stop loss is $0.05 away from your entry price, your target should be more than $0.05 away. You're probably looking for deals and low prices, but stay away from penny stocks.

These stocks are often illiquid, and chances of hitting a jackpot are often bleak. Many stocks trading under $5 a share become de-listed from major stock exchanges and are only tradable over-the-counter (OTC). Unless you see a real opportunity and have done your research, stay clear of these. Here we provide some basic tips and know-how to become a successful day trader. Whether a brokerage is regulated will determine who you can turn to if you're dissatisfied with the resolution of a trade dispute.

But I am surrounded in a community with professional traders and I can tell you that certain things are possible. Like I said I think it’s good to make people aware that it’s not a quick rich scheme, but in a trillion dollars market with 24/7 (except the weekend) access there are a lot of possibilities. But yes he showed me every single trade and his account growth. I understand that you want to give an honest view of currency trading.

With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. However you decide to exit your trades, the exit criteria must be specific enough to be testable and Currency ETF repeatable. Also, it's important to set a maximum loss per day you can afford to withstand—both financially and mentally. A physical stop-loss order placed at a certain price level that suits your risk tolerance.

Making lots of money through Forex trading is completely dependent on some special conditions. Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Imagine a trader who expects interest rates to rise in the U.S. compared to Australia while the exchange rate between the two currencies (AUD/USD) is 0.71 (it takes $0.71 USD to buy $1.00 AUD). The trader believes higher interest rates in the U.S. will increase demand for USD, and therefore the AUD/USD exchange rate will fall because it will require fewer, stronger USD to buy an AUD.

Forex Trading Risks

Instead of realizing that the stock is not simply oversold and that something else must be going on, she continues to hold the position, hoping it will come back so she can win (or at leastbreak even) on the trade. The focus on winning has forced the trader into the position where she doesn't get out of bad positions, because to do so would be to admit she lost on that trade.

There are many candlestick setups a day trader can look for to find an entry point. If used properly, the doji reversal pattern (highlighted in yellow in the chart below) is one of the most reliable ones. In most cases, you'll want to exit an asset when there is decreased interest in the stock as indicated by the Level 2/ECN and volume.

- The focus on winning has forced the trader into the position where she doesn't get out of bad positions, because to do so would be to admit she lost on that trade.

- How the person approaches the market will determine whether she/he becomes a successful trader or remains a perpetual gambler in the financial markets.

- Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, among several other reasons.

- Here at ForexBrokers.com, we follow the rigorous testing approach used by our sister site, StockBrokers.com, the most respected in the industry when it comes to trusted US stockbroker reviews.

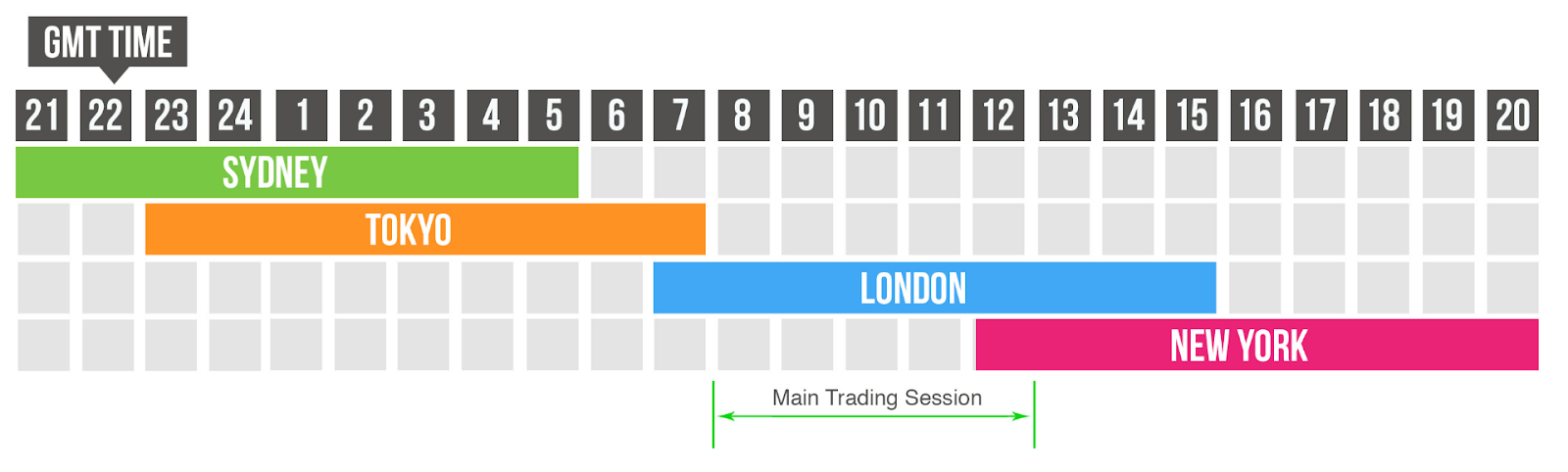

- The forex market is the largest and most liquid market in the world, representing every global currency with trading conducted 24 hours a day, five days a week.

- When choosing a forex broker for its FX research, remember that quality is just as important as quantity.

However, they are experienced business people who make a lot of money through several sources of income they have. And, as bank accounts are not leveraged, you will trade with more peace of mind. To make money consistently through Currency ETF and maybe to become a millionaire finally, you have to pass some important stages.

Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the largest and most liquid asset markets in the world. The foreign exchange (also known as FX or forex) market is a global marketplace for exchanging national currencies against one another. If you meet the eligibility requirements listed below, you can request permission to trade Cash Forex. If you are new to forex trading, take time to get a forex trading education and learn a bit about what you're doing.

The only problem of trading through a bank account is that you have to have a lot of money because banks don’t offer any leverage. You can keep making money with your source of income until you are ready to open a trading account. If your income is enough to trade through a bank account later when you are ready to do it, it will be even better. You will be faced with lots of negative emotions when you are still new and you want to trade with a too big account. None of the real millionaires or billionaires, like George Soros, have made their wealth through Forex or stock trading without following strong strategies.

A standard stop loss order, once triggered, closes the trade at the best available price. There is a risk therefore that the closing price could be different from the order level if market prices gap. When trading currencies, it's important to enter a stop-loss order in case the value of the base currency goes in the opposite direction of your bet. A simple stop-loss order would be 10 pips below the current price when you expect the price to rise or 10 pips above the current price when you expect the price to fall. When USD is listed second in the pair, as in EUR/USD or AUD/USD (Australian dollar-U.S. dollar), and your account is funded with U.S. dollars, the value of the pip per type of lot is fixed.

I sincerely would like to know if the writer of the article is a forex trader him/herself. But based on my own experiences I am always suprised how people in general tend to make like Forex is an almost impossible thing to do. I’m glad that I did what I believed in, because these kind of articles made me think that it was near impossible for me.

If you hold a micro lot of 1,000 units, each pip movement is worth $0.10. If you hold a standard lot of 100,000, then each pip move is $10. Pip values can vary by price and pair, so knowing the pip value of the pair you're trading is critical in determining position size and risk. If anyone wants to trade I will say to you learn the correct pschology to be a successful trader the marry that to money management i.e equity risked per trade and why (there is a reason behind it) correct position sizing.

Basic Day Trading Tips

But reading this article almost makes me feel like it’s impossible. Experience have proven that regulation can’t prevent the brokers from cheating the clients. Therefore, you’d better to start with a small account to test the water first. We will share Currency ETF more strong trading systems little by little that enables the traders to have trade setups every month. While they are learning to become consistently profitable Forex traders, they create a good source of income through the other systems we introduce.

Market participants use forex to hedge against international currency and interest rate risk, to speculate on geopolitical events, and to diversify portfolios, forex among several other reasons. Forex markets exist as spot (cash) markets as well as derivatives markets offering forwards, futures, options, and currency swaps.

High-volume traders can get up to 15% cash rebates on trades plus other exclusive benefits with our Active Trader Program. forex should and can be all about making a smart investment, taking the time to learn a system or strategy, practice and test it. Forextrading is not a ponzi-sheme, but there is an other danger that the potential trader should know about. You can track market prices, see your unrealised profit/loss update in real time, attach orders to open positions and add new trades or close existing trades from your computer or app on your smartphone and tablet.

Forex trading is not hard, but it feels hard early on in the learning process. With a little patience and persistence, anyone can learn how to do it. Jill buys a stock as she feels it is oversold compared to the rest of the market. The stock continues to fall, placing her in a negative position.

최근 댓글